Libya, a country located in North Africa, is bordered by Egypt to the east, Sudan to the southeast, Chad and Niger to the south, Algeria and Tunisia to the west, and the Mediterranean Sea to the north. Libya gained its independence in 1951. Libya's capital is Tripoli, and its official language is Arabic (although many Libyans also speak English or Italian as a second language). Libya's currency is the Libyan dinar (LYD).The momentous events of 2011, which resulted in the overthrow of a regime that had been in place for 42 years, has descended into political uncertainty giving rise to security issues. The oil sector, where production is significantly below pre-2011 levels, remains key to a more stable and peaceful future.PwC Libya (Al Motahedoon) has been serving clients in Libya for many years. During this period, the firm has obtained extensive experience in the Libyan marketplace, servicing both local and international clients alike.As a member firm of PwC, we provide assurance, advisory, and tax services. In the region of which we form a part, we are able to draw on the resources of the Middle East network as well as the wider network of the global firm.

The market for oil and gas upstream in Libya is expected to register a CAGR of more than 0.27% during the forecast period of 2020 – 2025. Factors, such as upcoming oil and gas exploration projects, along with increased production of oil and gas, are expected to boost the demand in the Libya oil and gas upstream market during the forecast period. However, the civil war in the country has severely impacted the growth in the sector, and it is likely to have a negative impact on the entire oil and gas industry in the coming years.

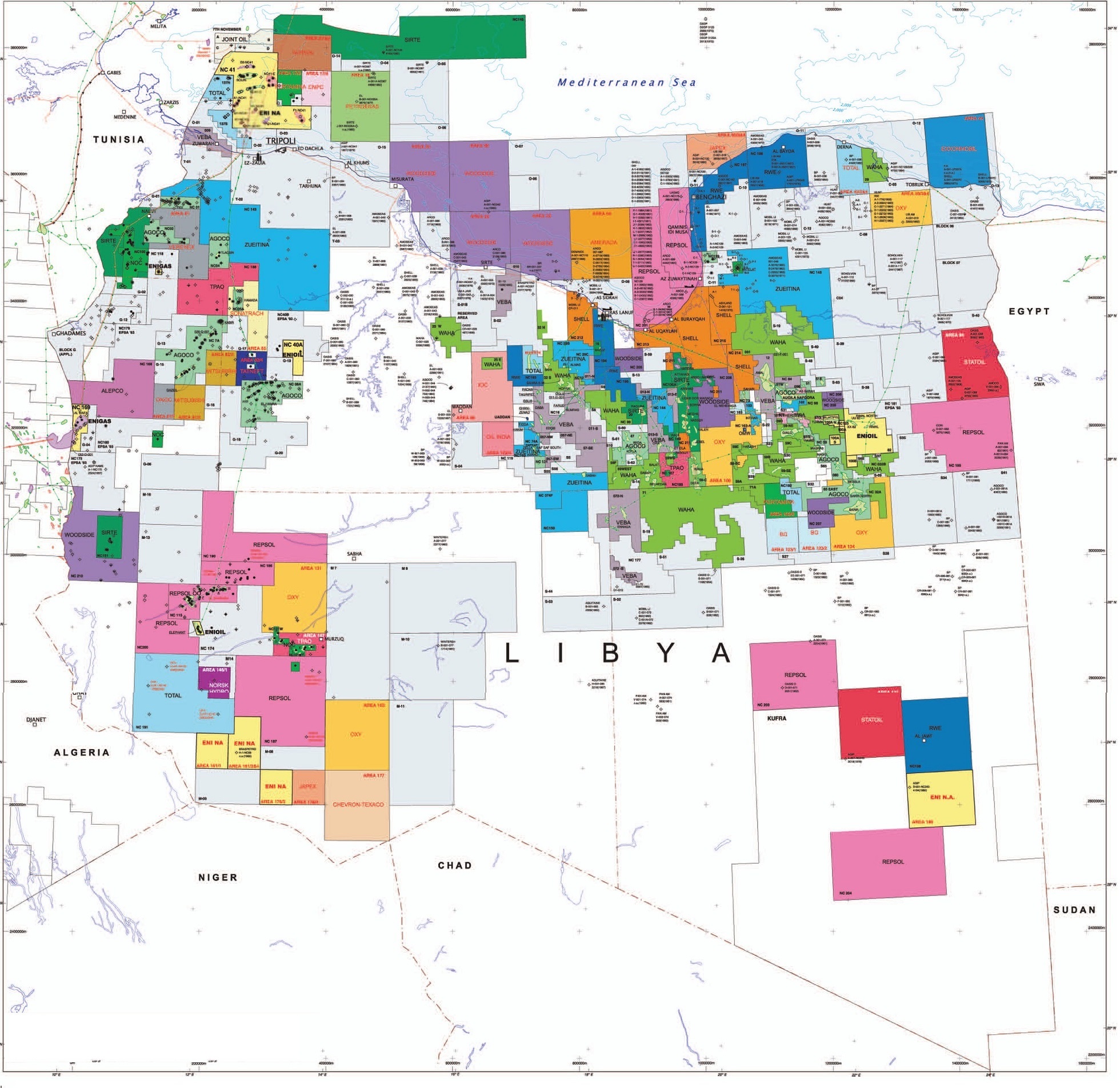

Most of the economically viable oil fields in the country are situated inland. Therefore, it is evident that the onshore segment dominated the market in 2019.

The growth in the oil and gas upstream sector has been severely impeded due to the ongoing civil war in the country. However, in 2019, as most of the country has come under the Libya National Army, the prospects of the civil war ending in the forecast period have increased. This, in turn, is expected to create an opportunity for companies in the market.

Now, the development of the current fields remains a top priority, as Libya seeks to meet phased production targets starting with 1.8 million bpd by the end of 2022.

The Libyan National Oil Corporation owns and operates several refining facilities and oil and gas processing companies, including Zawia, Ras Lanuf, Brega, Tobruk and Sarir refineries, with close to 380,000 bpd refined by NOC subsidiaries. Last month, the state-owned firm announced plans to construct a refinery in Sebha to be operated by NOC subsidiary Zallaf, which would produce cooking gas and jet fuel, among other petroleum products. The NOC also produces petrochemicals via the Ras Lanuf refinery that uses naphtha as feedstock and the Brega refinery that uses natural gas, as well as operates ammonia, urea and methanol plants.

In partnership with Libya’s National Oil Corporation (NOC), Italian multinational Eni is spearheading a large-scale oil project comprising the installation of two new fixed offshore platforms (A and E) opposite the Mellitah Complex. Commencing in the first quarter of 2023 and entering production in 2026, the project aims to monetize gas and condensate resources for both domestic use and regional export, with a combined gas production capacity of 760 million cubic feet per day upon completion. The project also requires upgrading an existing platform and constructing a network of subsea pipelines to deliver gas to an onshore processing facility. Bid processes for the engineering, procurement and construction of this infrastructure are already under way, with construction expected to begin in the first quarter of 2023.

The Waha concessions in Libya’s Sirte Basin are some of the most prolific in the region, producing around 300,000 barrels per day (bpd) and feeding into Libya’s Es Sider grade. Last November, the Libyan government approved the $300-million sale of Hess Corporation’s stake in the concessions to TotalEnergies and ConocoPhillips, boosting their respective shares to 20.41%. The asset has long-been at the center of redevelopment plans, as it contains more than 500 million barrels of oil equivalent and exploration potential spanning over 53,000 km². In December 2019, then-Total and the NOC signed an agreement that gave the French major a minority stake in Libya’s Waha asset, in which it would help the NOC to develop the North Gialo and NC 98 fields, increasing production by 180,000 bpd and investing $650 million.

Announced last October, Libya has begun construction of a $600-million oil refinery located near the Al-Sharara field in the Oubari region, which produces approximately 300,000 barrels of oil per day. The project is anticipated to take three years to complete and to generate approximately $75 million per year in income. According to the NOC, the refinery will produce 1.3 million liters of gasoline, one million liters of diesel and 600,000 liters of jet fuel daily, in addition to a cooking gas plant that will produce 8,000 cylinders per day. The construction of the refinery is significant for Libya, as the country is seeking to reduce chronic fuel shortages and add value to crude oil output in-country, as well as foster job creation and economic development in southern Libya.

France’s TotalEnergies has signed a preliminary agreement with Libya’s General Electricity Company of Libya (GECOL) and the Renewable Energy Authority of Libya to develop a 500MW photovoltaic (PV) solar plant in Libya.Under the terms of the agreement, TotalEnergies will develop a 500MW PV plant in the Al-Sadada area, 280km south-east of the capital Tripoli.The plant will be the largest solar plant in Libya and falls within the framework of collaboration between GECOL and REAoL.

GECOL said the project is part of the cooperation with the renewable energy apparatus to implement a strategic plan to add the power generated from the renewable energy project to the GECOL’s grid.The CEO of GECOL, Wiam Al-Abdali, said the project is the first and biggest in Libya, while the Head of the renewable energy apparatus said they would upgrade their work and use clean energy as part of 2022 plan that could see 25% of the generated power linked to the power grid.

RENEWABLE ENERGY PLANT, BANI WALID – 50 MWIn August, the Renewable Energy Authority of Libya (REAoL) announced plans to construct a 50 MW renewable energy plant on 75 hectares of land in the municipality of Bani Walid. The project will be connected to the electrical grid in the municipality and could be subject to additional development and expansion. The primary objectives of the plant include localizing technology, expanding the public grid, alleviating power shortages and supplying power to the region and network at-large.

SOLAR POWER PLANT, TAJOURA – 62 KWPLibya is set to construct a 62 kWp solar power plant in the Center for Solar Energy and Research in Tajura, located near the capital of Tripoli. Upon completion, the project will be connected to the national grid and will service the wider north-western region, with a view to reducing the country’s current power generation deficit of 1,500 MW. Construction of the plant is being led by Alhandasya, a Libyan company specialized in engineering services, electromechanical works and renewable energy development and implementation.

SOLAR PV PLANT, KUFRA – 100 MWPThe construction of a solar photovoltaic power plant is already underway in Kufra, with a planned capacity of 100 MWp. Occupying an area of 200 hectares, the plant will help achieve energy security for the local population by fortifying the electrical grid, which was previously supplied by a now out-of-service thermal power plant. In total, Libya is home to daily average solar radiation of 7.1 kWh per m2 in its coastal region and 8.1 kWh per m2 in its southern region, along with more than 3,500 hours of average annual sun duration and 140,000 TWh per year of concentrated solar potential.

ASSORTED PPP RENEWABLE PROJECTS – 2,000 MWREAoL recently announced its plans to implement projects totaling 2,000 MW, leveraging photovoltaic technology across multiple stages in the forthcoming years. The projects will primarily use public-private partnerships as the investment vehicle, although some projects with more urgent demand will be implemented solely through state participation. To advance the projects, REAol has requested that other authorities and institutions working in the renewable sector do not interfere, and has solicited government support in streamlining processes and procedures.

This site was created with the Nicepage